BSE Small Cap Index: Legal Risks in Construction Stock Investment

Exploring the intricacies of BSE Small Cap Index: Legal Risks in Construction Stock Investment, this introduction sets the stage for a deep dive into the topic. It aims to captivate readers with a blend of informative insights and engaging storytelling right from the start.

Further details about the topic are elaborated in the subsequent paragraph to provide a comprehensive understanding.

Overview of BSE Small Cap Index

The BSE Small Cap Index is a stock market index that tracks the performance of small-cap companies listed on the Bombay Stock Exchange (BSE) in India. Small-cap stocks are those of companies with a smaller market capitalization compared to large-cap or mid-cap companies.

Key Characteristics of BSE Small Cap Index

- The BSE Small Cap Index consists of stocks of companies with a market capitalization lower than those in the BSE Mid Cap Index and BSE Large Cap Index.

- These companies are typically newer or smaller in size, offering potential for growth and higher returns for investors willing to take on additional risk.

- Investing in small-cap stocks can provide diversification benefits to a portfolio due to their lower correlation with large-cap stocks.

Historical Performance of BSE Small Cap Index

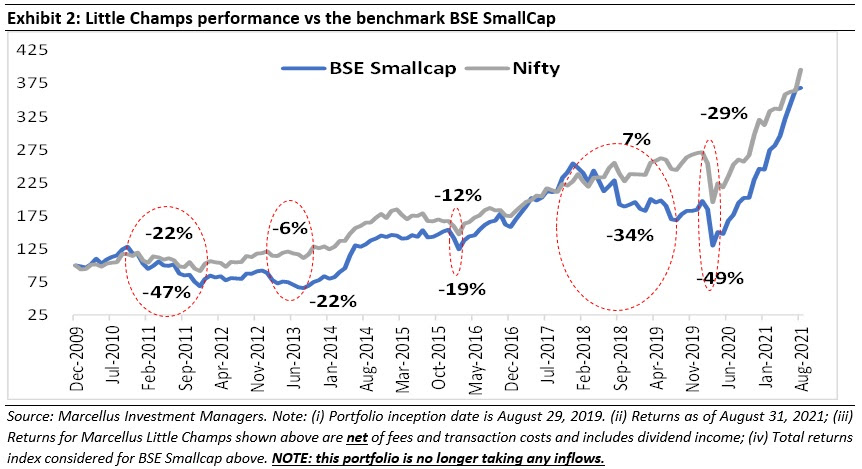

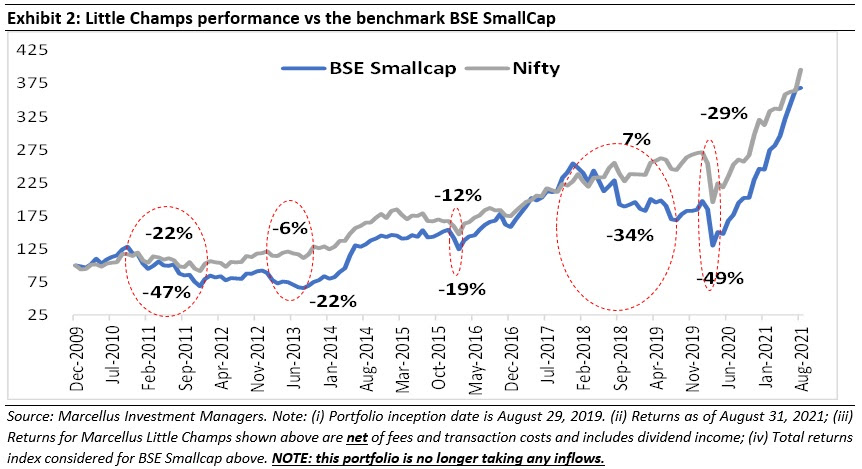

- Over the years, the BSE Small Cap Index has shown periods of high volatility but has also delivered strong returns during bullish market phases.

- Historically, small-cap stocks have outperformed large-cap stocks over the long term, although they may be subject to higher levels of risk and price fluctuations.

- Investors looking to capitalize on the growth potential of smaller companies often consider the BSE Small Cap Index as part of their investment strategy.

Legal Risks in Construction Stock Investment

Investing in construction stocks within the BSE Small Cap Index comes with its fair share of legal risks that investors need to be aware of. These risks can have a significant impact on the overall performance and stability of these stocks in the market.

Common Legal Issues in Construction Stock Investment

One common legal issue that investors may face when investing in construction stocks is the risk of contract disputes. These disputes can arise due to disagreements over project specifications, timelines, or payments, leading to costly litigations and delays in project completion.

Another legal risk is related to regulatory compliance, where construction companies may face fines or penalties for violating building codes, environmental regulations, or safety standards. Non-compliance with these regulations can not only result in financial losses but also damage the company's reputation.

Furthermore, legal challenges such as labor disputes, intellectual property infringement, or zoning issues can also impact construction stocks, affecting their profitability and long-term growth prospects.

Regulations and Compliance in Construction Stock Investment

Investing in construction stocks in India is subject to a regulatory framework that aims to protect investors and ensure transparency in the market. Compliance with these regulations is essential for investors looking to enter the construction sector through the BSE Small Cap Index.

Regulatory Framework for Construction Stock Investments

- The Securities and Exchange Board of India (SEBI) regulates the securities market in India, including construction stocks traded on the BSE Small Cap Index.

- SEBI's guidelines govern various aspects of construction stock investments, such as disclosure requirements, insider trading regulations, and corporate governance norms.

- Additionally, compliance with the Companies Act and other relevant legislation is crucial for construction companies listed on the BSE Small Cap Index.

Compliance Requirements for Investors

- Investors looking to invest in construction stocks need to adhere to SEBI's regulations, including conducting due diligence before making investment decisions.

- Compliance with disclosure norms, periodic filings, and reporting requirements is mandatory for investors in the construction sector.

- Maintaining transparency in transactions, avoiding insider trading, and following corporate governance principles are essential for compliance in construction stock investments.

Comparison with Other Sectors

- The regulatory environment for construction stocks in the BSE Small Cap Index is unique due to the sector-specific risks and challenges involved.

- Compared to other sectors, construction stock investments may require additional compliance measures, given the capital-intensive nature of projects and potential regulatory hurdles.

- Understanding the specific regulatory framework for construction stocks is crucial for investors to navigate the market effectively and mitigate legal risks.

Risk Management Strategies for Construction Stock Investors

Investing in construction stocks comes with inherent legal risks that investors need to manage effectively. By implementing proper risk management strategies, investors can mitigate these risks and protect their investments. Below are some key steps that investors can take to ensure compliance with regulations and minimize legal exposure in construction stock investments.

Due Diligence and Research

- Conduct thorough due diligence on construction companies before investing to assess their legal compliance record, financial health, and overall risk profile.

- Research the regulatory environment in which the construction companies operate to understand any potential legal challenges they may face.

- Consult with legal professionals or financial advisors specialized in construction stock investments to gain insights into specific legal risks and mitigation strategies.

Diversification and Portfolio Management

- Diversify your construction stock portfolio to spread risk across different companies and sectors within the construction industry.

- Regularly review and adjust your portfolio to respond to changing legal and regulatory conditions that may impact construction stocks.

- Monitor industry trends and news to stay informed about potential legal risks and regulatory changes that could affect your investments.

Risk Assessment and Mitigation

- Identify key legal risks associated with construction stock investments, such as contract disputes, regulatory violations, or environmental liabilities.

- Develop a risk mitigation plan that includes strategies to address each identified risk, such as insurance coverage, contractual protections, or contingency planning.

- Regularly assess and update your risk mitigation plan to ensure its effectiveness in managing legal risks in construction stock investments.

Conclusion

Concluding the discussion with a compelling summary, this section encapsulates the key points and leaves readers with a lasting impression of the insights shared.

Detailed FAQs

What are the common legal risks associated with investing in construction stocks?

Common legal risks include land disputes, regulatory non-compliance, and contract disputes that can impact investments.

How do legal risks affect the performance of construction stocks in the BSE Small Cap Index?

Legal risks can lead to financial losses, project delays, and reputational damage, affecting the overall stability and returns of construction stocks.

What regulatory framework governs construction stock investments in India?

The regulatory framework includes SEBI guidelines, land acquisition laws, and environmental regulations that investors must comply with.